How Can an Investment Fraud Lawyer Assist You?

Understanding Investment Fraud

Investment fraud is a pernicious threat that can defraud individuals and businesses of their hard-earned money, leaving devastation in its wake. It involves the intentional deception of investors where scammers present misleading information or entirely fictitious opportunities, promising significant returns that do not exist. This deceit is often crafted to appear legitimate and enticing, playing on human emotions such as greed, fear of missing out, and trust. The impact of such fraud is far-reaching, extending not only to financial losses but also emotional strain and shattered trust in future investment opportunities. Hiring a skilled legal counsel like a California investment fraud lawyer becomes imperative, serving as a crucial ally for victimized investors. These legal experts offer extensive knowledge in securities fraud laws, vigorously defending clients and striving toward recovery and justice.

Common Types of Investment Fraud

Investment fraud can take many forms, each with a unique method of enticing and deceiving victims. Ponzi schemes are the most recognized type, relying on new investments to pay returns to earlier investors, creating an illusion of a legitimate and flourishing business. However, these schemes inevitably collapse when the influx of new capital slows. Affinity fraud is another insidious type targeted at specific communities where trust is a strong bond—scammers often infiltrate religious, ethnic, or professional groups, exploiting their camaraderie. Meanwhile, high-yield investment programs tantalize potential victims with promises of extraordinarily high returns, claiming little to no risk. Such offers should sound alarm bells, as real and secure investments rarely guarantee returns, especially with such exaggerated assurances. Knowledge of the myriad forms of investment fraud is the first step in shielding oneself from these manipulative traps.

Role of an Investment Fraud Lawyer

The role of an investment fraud lawyer extends beyond mere legal representation; they serve as advocates for justice and restitution. Armed with in-depth knowledge of securities regulations and financial laws, these professionals meticulously examine every aspect of a fraud case. They parse complex legal jargon, interpret nuanced financial statements, and dissect layers of deceit laid by fraudsters. Their objective is twofold: to hold unscrupulous parties accountable and to recover as much as possible for their clients. Whether orchestrating negotiations for settlements or preparing for courtroom litigation, they employ every strategy to champion the rights of those defrauded. By handling legal complexities, they empower victims to reclaim control over their financial future without being overwhelmed by the intricacies of the legal system.

How Fraud Lawyers Help Recover Lost Investments

Fraud lawyers are pivotal in recovering lost investments and restoring financial equilibrium to affected clients. Drawing upon a comprehensive understanding of financial forensics, these lawyers collaborate with accounting experts to unravel the tangled web of fraudulent transactions. This deep dive into financial data is instrumental in building a robust case against perpetrators. By identifying patterns of misrepresentation and tracing funds, they lay the groundwork for compelling legal action. They craft powerful legal arguments toward achieving a court ruling or settlement that favors recovering lost funds. Their determination and precision can lead to successful recoveries, providing a lifeline to clients who might otherwise feel powerless against the tide of deception.

Red Flags That Signal Possible Investment Fraud

Awareness of red flags commonly associated with investment fraud can be a critical tool in prevention. Unsolicited offers, often delivered through sudden communications from individuals or groups claiming to have exclusive information, should be greeted with skepticism. Scammers frequently employ high-pressure sales tactics, urging quick decisions to create a false sense of urgency. This leaves little room for due diligence or thoughtful consideration. Moreover, promises of guaranteed high returns for minimal risk contradict the fundamental principles of legitimate investing, where risk is inherent. Further investigation is warranted if an opportunity lacks verification through credible, independent channels or seems reluctant to disclose critical information. Recognizing these signs empowers investors to dodge potential scams before they become victims.

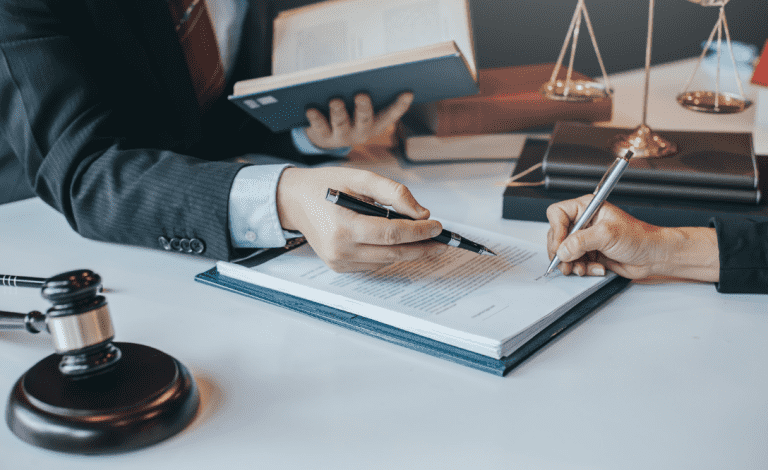

Finding the Right Investment Fraud Lawyer

Selecting the right investment fraud lawyer is a crucial step that can significantly influence the outcome of a case. It’s imperative to consider a lawyer’s track record and depth of experience dealing with similar cases, as this indicates their capability and expertise. Prospective clients should seek transparency in all communications—an effective lawyer will clearly map out their legal strategy and explain the possible outcomes honestly and objectively. Personal rapport and communication style should not be underestimated, as open dialogue fosters trust and enhances cooperation throughout the legal process. Informed decisions can be made by reviewing client testimonials, researching their professional standing, and conducting thorough interviews, ensuring alignment in expectations and the dynamics of lawyer-client relationships.

Preventing Investment Fraud

Prevention remains the most effective strategy against the threat of investment fraud. Prospective investors are advised to approach opportunities critically, conducting thorough research into the legitimacy and viability of any investment proposition. Consulting with established financial advisors or legal experts for an independent assessment can provide invaluable insights and safeguard against potential scams. Ensuring that individuals or firms offering investments are registered and compliant with corresponding regulatory frameworks fortifies this protection. Moreover, fostering financial literacy and awareness in oneself and within communities can be a powerful deterrent against fraudulent activities, contributing to a safer investment landscape for all. Through knowledge and vigilance, investors can protect themselves and contribute positively to the integrity of financial markets.