How to Successfully Buy Your First Home: A Comprehensive Guide

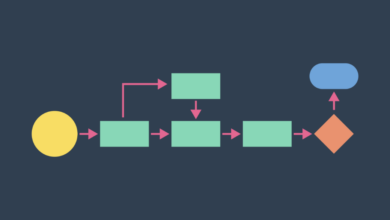

Understanding the Home-Buying Process

Buying your first home can feel overwhelming, but breaking it down into manageable steps can simplify the process. Start by researching neighborhoods, house types, and price ranges. Consulting a real estate agent can be invaluable in steering you in the right direction. Getting an overview of the market trends is vital for those looking at Concord homes for sale. Typically, the process begins with online research, visiting open houses, and exploring different neighborhoods. This initial phase provides a foundation that helps you understand what you can expect regarding home prices, property types, and neighborhood amenities.

Financial Preparation and Mortgage Options

Before you begin house hunting, make sure your finances are in order. Getting pre-approved for a mortgage is essential, allowing you to set a budget and show sellers you’re serious. There are various mortgage options available, from fixed-rate to adjustable-rate mortgages. Resources can provide valuable insights into choosing the right mortgage for your situation. Understand your financial situation by calculating your debts, savings, and income. Aim for a low debt-to-income ratio, which impacts how lenders view your loan application. Also, remember to save for a down payment, as this significantly affects your borrowing capacity and the types of loans available.

Choosing the Right Location

Deciding where to live is the most crucial aspect of buying a home. Consider factors such as proximity to work, school quality, shopping centers, and community amenities. It’s wise to visit potential neighborhoods at different times of the day to gauge their vibe. Websites offer helpful tips on what to look for in a neighborhood, helping you make an informed decision. Take note of factors like safety, convenience, and future development plans. Don’t forget to consider your long-term plans—whether you plan to stay for a few years or many can impact your choice of location. Engage with locals, if possible, to get firsthand information about the community’s advantages and drawbacks.

Deciding on the Type of Property

Whether you opt for a single-family home, condo, or townhouse depends on your lifestyle and financial situation. Single-family homes often offer more space and privacy, ideal for families or those planning to grow theirs. Condos might be perfect for people looking to minimize maintenance responsibilities, while townhouses offer a mix of both. Make sure to weigh the pros and cons of each to find what suits you best. For instance, single-family homes may come with higher maintenance costs and responsibilities but offer more freedom in terms of customization. Conversely, condos might have lower maintenance responsibilities but come with homeowner association (HOA) fees and shared walls with neighbors. Carefully consider your lifestyle needs and plans when making this decision.

Making an Offer and Negotiations

Found your dream home? The next step is to make an offer. Your real estate agent can help you draft a competitive bid. Be prepared for negotiations; factors like the home’s condition and market competition will influence this stage. It’s crucial to stay within your budget while aiming to make a compelling offer. Understanding the market dynamics—whether it’s a buyer’s or seller’s market can significantly impact your negotiation power. Don’t hesitate to include contingencies that protect your interests, such as financing, inspection, and appraisal contingencies. Flexibility in your terms, like the closing date, can sometimes make your offer more attractive to the seller without increasing the purchase price.

Inspections and Appraisals

Home inspections and appraisals are vital to ensure you’re making a good investment. A thorough inspection can uncover potential issues affecting the home’s value or require costly repairs. Similarly, an appraisal will determine the property’s fair market value, which is crucial for securing a mortgage. Ensure you hire a reputable inspector to assess the property’s condition thoroughly. You can negotiate repairs or a price reduction if significant issues are found. Appraisals also provide an objective valuation, protecting you from overpaying for the property. Sometimes, the seller might take care of necessary repairs, but knowing it’s what you’re getting into before closing the deal is essential.

Closing the Deal

It’s time to close the deal once the negotiations are settled and inspections are done. This involves signing various documents, including the loan agreement and the deed. Understanding each document you sign is crucial, so don’t hesitate to ask your agent or lawyer for clarification. Once everything is signed, you’ll get the keys to your new home! Be prepared for closing costs, including mortgage insurance, title insurance, and other fees. Reviewing its closing disclosure with your real estate agent or attorney beforehand is a good idea so you know what to expect. Finalize your move-in plans, transfer utilities, and change your address ahead of the closing date to ensure a smooth transition into your new home.